IND AS 41 : AGRICULTURE

Accounting

treatment for Biological assets are given in the Ind As -41. Previously There

are no standards are given for the agricultural sectors in India therefore Ind

As 41 is derived for proper treatment of the biological Assets and transactions

related to the sectors.

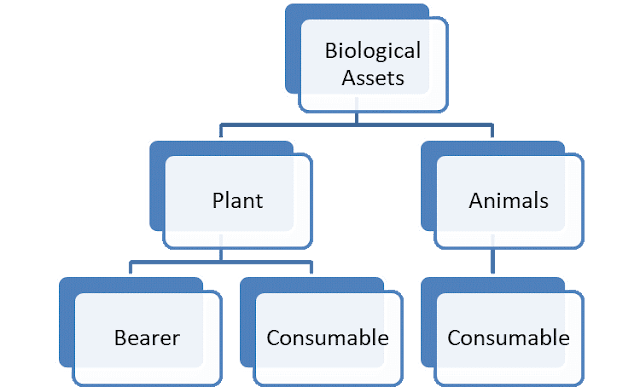

First lets understand, what is biological Assets?

· Living

Plant & living Animals are called as biological Assets.

Types

of biological Assets:

Bearer

Plants: Bearer produces for more than one year. For eg. All fruits Bearing

Plants.

It

is derived in Ind As 16- PPE as self-constructed Assets

Consumable

Plants: Directly usable in ply or lumber (Furniture and Fittings).

Consumable

Plant and consumable Animals are derived in this standard which Ind As 41.

Agriculture:

Management of biological transformation of biological assets.

Transformation

in the form of Quality and Quantity.

Quality:

Change in Nutrients level

Quantity:

Change in Weight and Structure.

Agricultural

Activity:

Agricultural activity is

management of biological Assets and harvest of biological assets and

agricultural produced.

Recognition

of biological Assets:

1. Future Benefit is probable.

2. Biological Assets is controllable

3. Fair value can be measured reliably.

Accounting Treatment:

Purchase:

Biological Asset Dr.

P&L A/c (purchase exp) Dr.

To cash A/c

To P&L A/c (balancing figure)

Self-Generated:

Biological

Asset Dr.

To

Fair Value Gain (P&L)

Note:

Biological Asset is recorded at fair value less cost to sale.

Operating Expenses:

Expenses

(P&L) Dr.

To

Cash A/c

Government Grant related

to agricultural activity:

Govt.

Grants are of two types:

1. Conditional:

Receipt of conditional

Grants:

Bank A/c Dr.

To Deferred govt. Grant

(liability)

When condition for the

grant are met:

Deferred govt. grants Dr.

To P&L A/c

2. Unconditional:

Recognized as Income upon

Receipt:

Bank A/c Dr.

To Govt. Grant A/c

(P&L)

Sale

of Biological Assets:

Cash A/c Dr.

To Sales Revenue

Conversion

into Inventory:

Inventory Dr.[Fair value

less cost to sale]

P&L (B.F.) Dr.

To Biological Asset

To Cash A/c

To P&L (B.F.)

Valuation at reporting

date

Increase:

Biological Assets Dr.

To Fair Value gain

(P&L)

Decrease:

Fair Value loss (P&L)

Dr.

To Biological Assets

Comments

Post a Comment